Dream big; start small.

Ten people, ten dollars, and one good idea is all it takes to begin.

None of us is free until all of us are free.

In the meantime, we work.

This work is love.

We will not stop until our work is done.

Our work is done when our vision becomes reality.

The Need

The student debt crisis presents a multifaceted challenge with profound implications for individuals, communities, and the economy. Escalating tuition costs are formidable barriers to accessing higher education, disproportionately affecting marginalized groups and perpetuating cycles of inequality. The weight of student debt not only undermines personal financial stability and mental well-being but also stifles economic growth and innovation. Moreover, it intersects with other social issues, exacerbating disparities in pay, wealth, and opportunity. Addressing this crisis is imperative to foster a more equitable and inclusive society and economy, and to liberate the potential of present and future generations.

Our Experiment

In 2018, a collective of ten founding alumni and former students, some with college debt and some without, formed the Debt Liberation Laboratory as a social experiment in collective debt reduction. Step one: pay down and relieve our own college debt. Step two: share what we learn and create a nonprofit model that other friends and alumni can use. In 2020, the Debt Liberation Laboratory received not-for-profit organization status under part 501(c)(10) of the IRS code.

The Debt Liberation Laboratory meets monthly and publishes a newsletter to share our progress. Those interested in learning more about accelerating this project can reach us at

Click here to sign up for our newsletter.

Dream big; start small.

Ten people, ten dollars, and one good idea is all it takes to begin.

None of us is free until all of us are free.

In the meantime, we work.

This work is love.

We will not stop until our work is done.

Our work is done when our vision becomes reality.

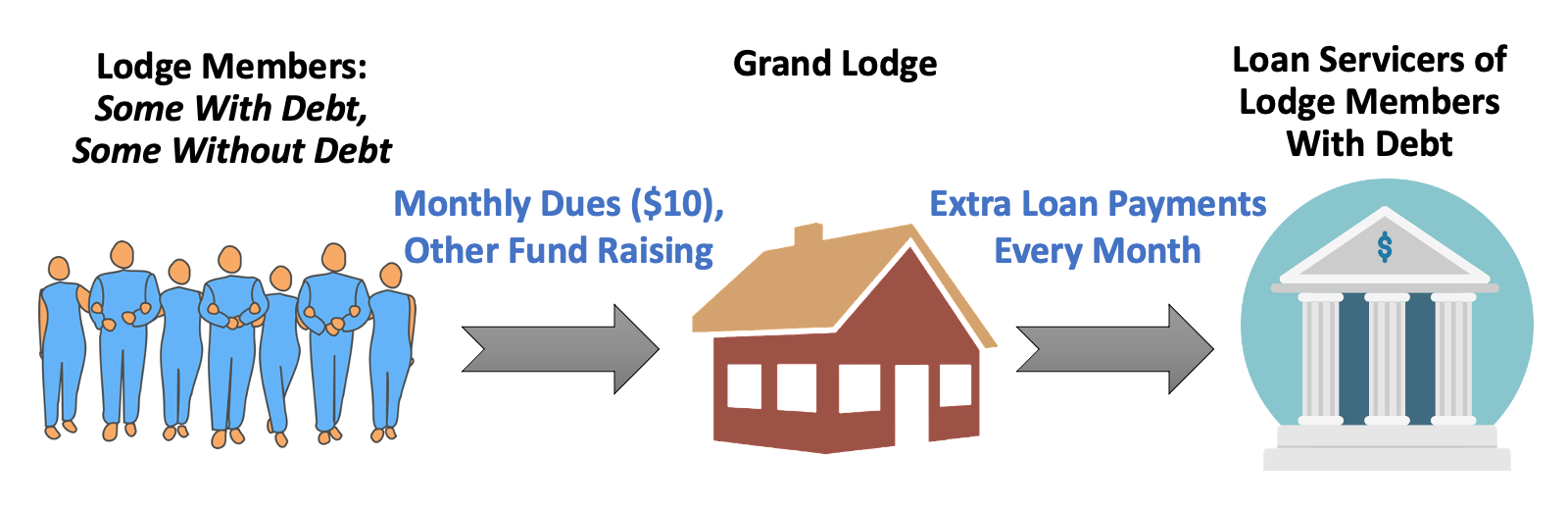

Lodges:

- Groups of 5-13 members

- Some members have student debt, some do not

- All are committed to reducing the members' student debt

- Members share information about student debt and pay-down progress

- Members with student debt must stay in good standing with their loan servicer

Extra payments:

- Boost payments happen every month

- Every lodge member with student debt gets a boost payment

- Boost payments go directly to loan servicers to ensure debt reduction

- Boost payment size: the lodge's monthly income, divided by the number of members with student debt

- Boost payments get bigger as a lodge retires student debt

Fund raising:

- Members pay monthly dues

- Members may donate

- Non-members may donate to lodges or the Grand Lodge

- Non-members may donate for debt reduction or operating expenses

Operating expenses:

- Paid by donors, not by lodges

Grand Lodge:

- Acts as a financial clearing house for lodges

- Transparently reports all monthly transactions to the lodges

- Provides organizational umbrella

Starting with a group of ten friends with just under $100,000 of combined undergraduate student debt in 2018, as of winter 2024, we have paid off 70% of this original debt burden, and three of us who started the project with debt are now undergraduate college debt-free.

Today, Lodge 1 of the Debt Liberation Laboratory is down to three members with outstanding loans and a balance of $55,288.81. All of us pay ten dollars a month in dues, which are evenly distributed to our outstanding loans. Those of us who can also make additional contributions to further accelerate our collective debt repayment. Those with debt also make standard loan payments. Others who believe in what we are doing make gifts.

There is no magic trick to it. When our current balance is paid off, the project won’t stop. We will shift our focus to using the nonprofit model we are innovating to reduce the debt of others.

Our progress:

- At the founding, March 2018

- Number of founding members: 10

- Number of members with student loans: 5

- Total student loan debt: $99,961.15

- Home college: Bennington College, Bennington, VT

- As of April 2020

- Number of members: 7

- Members with student loans: 2

- Total student loan debt: $41,130.20

- As of March 2021

- Number of members: 7

- Members with student loans: 1

- Total student loan debt: $17,791.37

- As of March 2022

- Number of members: 8

- Members with student loans: 2

- Total student loan debt: $31,129.74

- As of March 2023

- Number of members: 9

- Members with student loans: 3

- Total student loan debt: $60,688.30

- As of March 2024

- Number of members: 9

- Members with student loans: 3

- Total student loan debt: $55,288.81

Page 1 of 2